Easy Money Undermines Social Mobility

Central banks around the world target a stable price inflation rate of 2 percent annually over the medium term. This is widely considered to be monetary policy’s most important contribution to the smooth functioning of a dynamic economy. This view is wrong on multiple grounds, but there is one problem with it that is commonly ignored. Inflation, even if it remains relatively moderate, can contribute to rising inequality and undermine social mobility. It therefore poses a serious threat to a free and market-based economy. Few things are as potent as inequality, especially inequality caused by the inherently unjust process of inflation, in stimulating further fiscal interventions, higher taxes, and redistribution.

Inflation, even if it remains around 2 percent, creates strong incentives for households to change their saving and investment behavior. Both kinds of changes affect the distribution of income and wealth.

As money loses its purchasing power over time, households are incentivized to redirect their savings into asset classes that can potentially protect them against that loss. Inflation therefore generates an overproportionate shift in demand from nominal assets, such as cash and deposits, to real assets, such as stocks and real estate. The inflationary process thus generates overproportionate asset price inflation. European real estate markets provide one of the most striking examples in recent decades: housing price inflation has swept all European Union countries, though the onset has admittedly been staggered.

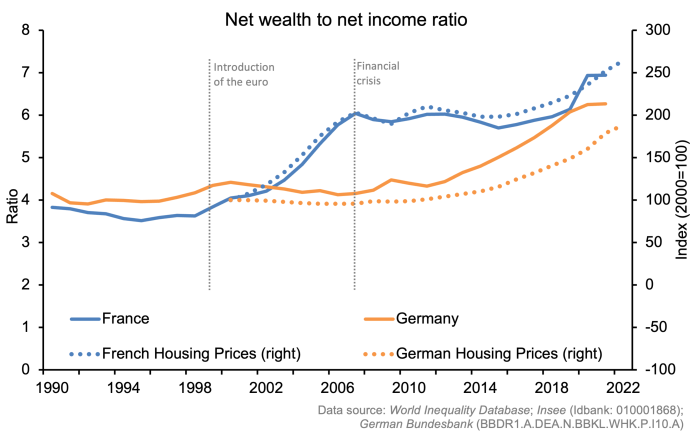

When the euro was introduced in 1999, it took only eight years for average housing prices in France and other southern European countries to double. During the same period housing prices in Germany remained constant. Only after the outbreak of the financial crisis of 2007 and with the advent of quantitative easing did housing prices in Germany begin to increase. They have since doubled. In France there was no correction of housing prices after the crisis. They remained high and have increased even further in recent years.

Overproportionate asset price inflation can be observed in many other markets. The German stock market index DAX, for example, has increased by about 4.5 percent annually since the introduction of the euro. During that same period, the German economy has grown only by about 1.2 percent per year in real terms and average consumer price inflation has been calculated to be about 2.0 percent per year, including the most recent spike.

The overproportionate rise of asset prices has direct implications for wealth inequality. The gap between those who own assets and those who do not (yet) own assets increases. Households that own assets whose prices rise overproportionately enjoy a positive wealth effect from inflation and become richer relative to others.

As the existing wealth distribution is reinforced, it becomes harder to climb up the wealth ladder without a higher income. Social mobility is thus undermined. One common statistic used to analyze social mobility is the wealth-to-income ratio. As the graphic shows, both France and Germany have seen strong increases in their wealth-to-income ratio. These increases are closely tied to the inflation of housing prices. An increase in the wealth-to-income ratio indicates that the monetary value of total wealth has increased relative to total annual income. The higher the wealth-to-income ratio, the higher the opportunity costs of climbing up the wealth ladder.

This can be illustrated by a back-of-the-envelope calculation. Imagine a wealth-to-income ratio of 3.5, as in France during the mid-1990s. At that time the monetary value of total wealth in France was 3.5 times as high as the total annual income of the French population. This ratio implies that starting from zero with an average income and a saving rate of 10 percent, all else held constant, it would take thirty-five years to build up an average wealth position from zero. If the wealth-to-income ratio is 7.0, as in France today, it would take seventy years. This means that people starting from zero must work longer and sacrifice more in terms of consumption forgone to make it to the average wealth position. Discouragingly, building up wealth for the future has become harder.

The situation is even worse when you keep in mind that most people do not receive an average income. The income distribution is skewed, and many people remain below the average.

Households that are dependent on labor income are especially harmed by rising wealth-to-income ratios because the growth rate of wages lags far behind that of asset prices.

This, too, can partly be explained by inflation and a crowding-out effect in investment behavior. Overproportionate asset price inflation makes speculative investments, that aim at making a profit from simple price hikes by buying and selling at the right moment, more attractive relative to productive investments in the real capital stock. But productive investments are needed to increase labor productivity and real wages in the long run. A lack of productive investments undermines the growth of real wages and thus hits wage earners hardest.

To understand the above analysis, it is important to realize that the wealth-to-income ratio does not say anything about the living standard. The ratio can be high in very poor countries, and it can be low in very rich countries. The ratio of the United States, for example, is lower than that of France, despite the fact that Americans are richer on average. Even though we observe the same overall trend toward a higher ratio in the US, the American ratio had never exceeded 5.4, its value at the peak of the housing bubble, until 2020, when it was pushed above 6.0.

One reason why the wealth-to-income ratio is still lower in the US than in many European countries is taxation. In Europe, income, especially labor income, is taxed more heavily than in the US. This is one thing that the US has still going for it: incomes are allowed to be relatively high, and it is easier to make it to the top half of the wealth distribution even if you come from a modest background. In Europe it is difficult to advance without owning wealth in the first place.

This is, of course, only a relative advantage for Americans. The overall trend is the same. It certainly does not hurt to inherit some wealth as an American. In the US, too, there are big strata of the population that feel left behind and have the suspicion that the system is rigged against them. And this suspicion is not entirely unjustified. These developments can be very dangerous if their causes are not properly understood.

The European administration is currently preparing to create a centralized wealth registry of all European households, which would make the implementation of wealth taxes easier and more efficient. The official goal of the registry is to fight crime. The administration is not openly saying that taxation of wealth is planned, but the registry would be an obvious means to fight against inequality—an issue of growing concern. And the people are more likely to fall for such fiscal measures if they feel that the inequality is fundamentally unjust, which it is if it is based on inflation.

The right way to tackle the problem of inequality is to end inflationary monetary policies. This would not eliminate inequality completely because any dynamic and prospering economy will bring about inequalities. But if inequalities are the result of productive action, they do not go against a common sense of justice. A fortune made through production is a fortune made by serving others. But a fortune made from inflation is a fortune made at the expense of others. Putting an end to inflationary monetary policies would prevent the latter and the unjust inequalities that come with them.