A New, Depressing Survey on Inflation

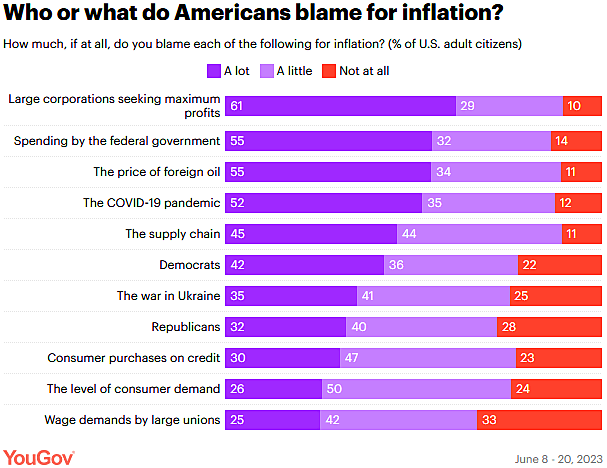

Extensive media coverage of the idea of “greedflation” seems to be affecting public opinion. A new YouGov polling survey undertaken in June 2023 finds that more Americans blame inflation on “large corporations seeking maximum profits” than any other option they are given.

A massive 61 percent of U.S. adults think profit‐hunting corporations deserve “a lot” of blame for inflation, up from 52 percent in 2022 (see chart below). For context: this exceeds the number who blame spending by the federal government, the price of foreign oil, the war in Ukraine, or the level of consumer demand. Independents saw the biggest swing towards this profits‐led inflation explanation, which surely reflects the disproportionate broadcast and print media coverage of a “heterodox” theory that academic economists regard as kooky.

When the last version of this YouGov survey was undertaken in October 2022, I was harshly critical of it. The questions seem almost designed to confuse the public about what inflation is. Ask most mainstream economists and they will say that, to a first approximation, inflation is a macroeconomic phenomenon driven by too much money chasing too few goods. These days they might talk in terms of aggregate demand and aggregate supply instead, to be more general. And yet, when offering up a menu of boogeymen to blame, YouGov doesn’t even list “the Federal Reserve” for censure. This, despite the Fed’s inflation mandate and the fact that macroeconomists see the Fed as the key institution affecting aggregate demand.

Effectively omitting low interest rates, quantitative easing, or an increased money supply as explanations for inflation, all that’s really left is government spending, supply‐shocks from overseas, and various quack theories or partisan flexes. Little surprise then that when asked what government policies they believe would reduce inflation, the public’s modal choices include “increasing domestic oil production,” “investing in strengthening the supply chain [sic],” “having the government enforce limits on price increases,” and “fining companies for price gouging.”

The increase in the perceived effectiveness of price controls is the most striking and worrying. Fifty‐one percent of respondents now think that “having the government enforce limits on price increases would “probably or definitely decrease inflation” compared to 44 percent from those surveyed last October. This, despite the long, inglorious history of price controls as a failed means of controlling inflation.

The greedflation story, as popularized by Senator Elizabeth Warren, clearly makes little sense. Companies didn’t suddenly get more greedy in 2021 and 2022, and then less so of late. There’s no reason to think there were massive changes in market power that led firms to suddenly be able to increase the level of prices either. And the idea that inflation allowed firms across different industries to suddenly tacitly collude to all raise prices simultaneously far beyond their cost uplifts ignores an inconvenient fact: consumers still need to be willing and able to pay the higher prices. This is only possible in a world where there’s more money for them to demand the products, begging the question: was too much aggregate demand the ultimate driving factor?

Overall, this polling is profoundly depressing. Inflation isn’t seen by the public as a macroeconomic phenomenon that requires different macroeconomic policies to avoid or mitigate. Looking at the answers in the round, it’s clear that the public instead interprets “inflation” as synonymous with “the cost of living.” Hence any policy that those surveyed think will reduce their living costs—whether holding down certain prices, cutting interest rates, making more oil available, or cutting taxes—is seen by more people as likely to reduce inflation rather than increase it.