The Federal Reserve is Running Losses. Does This Cost Anyone Anything?

Financial statements of the US Federal Reserve, which consists of the board of governors in Washington and twelve district reserve banks across the country, indicate that the consolidated system has generated both capital and operating losses for the past couple of years. The Fed was created in 1913 to issue and circulate an “elastic currency” that could respond to consumers’ demand for cash, end bank runs known then as “money panics,” and serve as a “lender of last resort” to the nation’s commercial banks. How is it possible that the Fed could be losing money after one hundred years of operation?

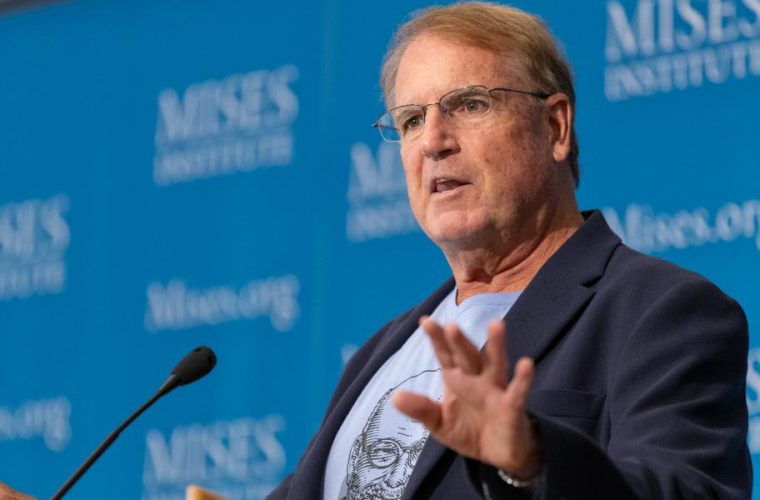

The debate has raged in the banking and finance communities. Two investigators, Paul Kupiec at the American Enterprise Institute and Alex Pollock at the Mises Institute, have analyzed Fed financial statements and presented their findings about these Fed losses in publications such as the Wall Street Journal and on the websites of the American Enterprise Institute, the Mises Institute, the Federalist Society, and Law and Liberty. The Wall Street Journal has produced a nontechnical video explaining how the Fed makes (and loses) money.

Capital Losses and Operating Losses

The Fed’s capital losses are derived from its large bond portfolio of low-coupon US Treasury and mortgage-backed securities purchased in earlier times of low rates during the period of quantitative easing following the 2008–09 financial crisis. As the Fed has now raised interest rates in its efforts to reduce inflation, the market value of its bond portfolio has inevitably declined. Estimates of these capital losses range as high as $100 billion. The bond portfolio resides in the System Open Market Account, which is managed by the Federal Reserve Bank of New York on behalf of the entire Fed system.

The Fed’s operating losses, on the other hand, result when its expenses run higher than its revenues. The Fed’s revenues consist mostly of interest income on its large bond portfolio. The Fed’s expenses include payment of interest on commercial banks’ reserves on deposit at Fed district banks and reverse repurchase (repo) transactions with money market funds, as well as Fed overhead expenses such as the operations of the Consumer Financial Protection Bureau, which is funded by the Fed rather than as an independent agency funded by Congress. The US Supreme Court is currently considering the constitutionality of this funding arrangement between the Fed and the Consumer Financial Protection Bureau.

The Fed’s expenses are annually running $100 billion above Fed revenues, with potentially higher levels later. Such operating losses are unique for the Fed, which throughout its years of operation has generated annual surpluses. These surpluses are by law transferred to the US Treasury to help pay the many governmental expenses such as defense, entitlement programs, interest on federal debt, and the many other myriad federal outlays.

Are These Losses Genuine, and Who Pays for the Losses?

The Fed’s operating and capital losses are genuine in both an accounting and an economic sense. Though the Federal Reserve has designed its own accounting rules rather than subscribing to those of the Financial Accounting Standards Board, the Fed’s own financial reports clearly show ongoing accounting losses by any metric. And because of interest rate increases since 2022, the market value of the Fed’s portfolio of Treasuries and mortgage-backed securities has declined.

Both types of losses are also genuine in terms of the economic principle that one cannot gain something for nothing, that nothing is “free” despite claims to the contrary, and every action or choice taken in life always incurs an opportunity cost measured as the cost of the foregone option.

Economics also analyzes the incidence of costs—that is, on whom the cost burden actually falls, which is not necessarily the party on whom it may initially appear to fall. Although a retail sales tax, for example, is nominally paid by a buyer at the point of sale, further analysis reveals that the incidence of a sales tax falls on both buyer and seller (but not necessarily in equal shares), depending on the relative price elasticities (i.e., responsiveness to price changes) of supply and demand for the item in question. With respect to the Fed’s losses, on whom these losses fall is another matter, but economic analysis clearly shows that these losses are not without costs to one or more parties.

Two candidates are likely to absorb the Fed’s operating losses:

American taxpayers as a whole. Now that the Fed is incurring operating losses instead of surpluses that would otherwise be paid over to the US Treasury, federal budget deficits are commensurately larger, requiring the Treasury to sell more debt in order pay its bills. This is an obvious cost to American current and future taxpayers.Commercial banks that are members of the Federal Reserve system, which are required to buy and hold stock shares in their respective Fed district banks. The 1913 Federal Reserve Act specified that these member banks could be assessed for Fed system losses. If the Fed were to make this demand of its member commercial banks, they would be obligated to cover the Fed system’s losses. Again, there is no precedent for this.

An Alternative View of the Fed’s Losses

Some observers disagree that the Fed’s operating and capital losses must be borne by one or more parties. Jason Furman, a professor at Harvard University’s John F. Kennedy School of Government and former chair of President Obama’s Council of Economic Advisors, expresses an alternate view. In a recent Wall Street Journal op-ed, he explains that the Fed turned a cumulative profit of over $1 trillion from 2008–22, and that current annual losses of about $100 billion do not impede the Fed’s ability to fulfill its mandate to ensure maximum employment and price stability.

With rising interest rates, the Fed is paying higher rates to commercial banks’ deposits held at Fed district banks, well in excess of what it earns on its portfolio of Treasury and Mutual Broadcasting System securities. Now that the Fed is running losses, it simply books them as a “deferred asset,” an accounting technique unique to its own accounting rules.

Furman further explains that the Fed was never designed to turn a profit, and that the Fed need not hold any capital because insolvency is a meaningless concept in the world of central banking. He also explicitly notes “partisan gamesmanship and shortsightedness” as a reason not to denigrate the Fed’s fluctuating profits as it apolitically fulfills its mandated responsibilities.

Kupiec and Pollock responded with a letter to the editor of the Wall Street Journal to reiterate their earlier conclusions that American taxpayers will ultimately bear the cost of the Fed’s losses. When asked by email how he can justify his claim that no one, including taxpayers, actually bears the cost of the Fed’s losses, Professor Furman responded as follows:

The Fed’s losses do lead to higher debt. And its gains to lower debt. On net it has reduced the debt. But it is a public entity and we didn’t assign it the job of maximizing profits—and for good reason—we should leave that to the private sector. Instead we assigned it macroeconomic goals which it has done well at times and done badly at other times—like in not responding fast enough to inflation in 2021.

Why It Is Important to Understand This Controversy

The accounting analysis clearly indicates that the Fed system is presently incurring both operating and capital losses. Honest differences of opinion can arise, but numbers do not lie. And economic principles tell us that no one can reap something for nothing, that the costs and benefits of any action will always redound to one or more parties.

Do political agendas perhaps explain the differences in opinion about the Fed’s losses? Is it possible that investigators at two right-of-center think tanks can read the data so differently than does an Ivy League university professor?

Denying that taxpayers will ultimately bear the cost of the Fed’s dual losses is tantamount to averring that inflation isn’t a tax on everyone, or that federal student loan forgiveness doesn’t cost taxpayers anything. If the Federal Reserve system truly were able to withstand continuing losses into the future with no consequence or cost, it may prove a bigger bonanza for American taxpayers than alchemists believed they could achieve when attempting to transform base metal into gold.