My Long Journey to Rothbardian Sobriety

Everything possible is done to prevent the fraud of the monetary system from being exposed to the masses who suffer from it.

—Rep. Ron Paul (R-TX), before the US House of Representatives, February 15, 2006

In the mid-sixties, having read about gold in Atlas Shrugged, I decided to find out something about inflation and wrote to the United States Treasury Department to request a brochure that purported to lay inflation out in terms anyone could understand. In reply, they sent me a Peanuts comic book.

Though I didn’t know it at the time, using cartoon stars to promote government viewpoints was nothing new. In 1942, the US Treasury had commissioned Walt Disney to produce a film called The New Spirit in which Donald Duck’s radio tells him it is “your privilege, not just your duty, but your privilege to help your government by paying your tax and paying it promptly.” The following year, the government revoked that “privilege” and imposed Milton Friedman’s withholding idea, an insidious way of reducing the transparency of the income tax while making it easier to raise taxes in the future.

Like Donald Duck a generation earlier, the Peanuts gang attempted to charm people into the state’s bed. According to the comic book, inflation, you see, was a rise in prices. If we want robust economic growth and low unemployment, some inflation is necessary. Inflation was only bad if it got out of hand. However, we needn’t worry because, here in the US, we were privileged to have an agency called the Federal Reserve ready to pounce on inflation if it got too high or too low.

Charlie Brown and company were singing the same tune as my 1967 Armen Alchian and William Allen economics textbook, which states flatly that “Inflation is a rise in the general level of prices.” At that time, World War II was the “good war,” withholding was temporary, and moderate inflation was a good thing—even if, at 3 percent, the dollar loses half its value in fourteen years.

Hazlitt and Mises

A little later, I descended into the catacombs of dissent and discovered authors no one ever talked about, such as Henry Hazlitt and Ludwig von Mises. In particular, I found this astonishing claim on page one of Hazlitt’s What You Should Know about Inflation: “Inflation, always and everywhere, is primarily caused by an increase in the supply of money and credit. In fact, inflation is the increase in the supply of money and credit.”

Hazlitt was saying our leaders were in the business of manufacturing money. Later on, he said the cure for inflation was to stop inflating. “It is as simple as that.”

This was during the late 1960s, the guns and butter years of the Johnson administration, when Vietnam and the Great Society were bleeding people literally and financially and when few books challenged the status quo on money and banking. No authoritative voice condemned the government for inflating the money supply to pay for the slaughter overseas and the handouts at home. Inflation was a topic of discussion only because goods and services started to cost more. The blame for that, of course, was placed on business and labor, not government. When seen only as a rise in prices, inflation not only shields the guilty, it places them in the role of the people’s champion.

Discovering Rothbard

Then, sometime in the 1990s, I read Murray Rothbard’s What Has Government Done to Our Money?

Rothbard filled in the gaps. He discussed how money emerged from barter economies as well as how banks came into being and began loaning out its depositors’ money without their knowledge. Rothbard explained how government, always hungry for revenue, came to the aid of the banks whenever their depositors lined up demanding their money. This aid allowed bankers to suspend specie payment, sometimes for years, while letting the banks remain in business. Rothbard talked about how the government imposed a central bank on the economy to safeguard the bankers’ racket of fractional reserve banking, which most of the world accepts as normal and uncontroversial. This allowed the central bank, as the monopolist in control of the money supply, to “buy” government securities in the manner of a child playing make-believe—with money created out of thin air. The government could then use this money to do whatever furthered its own interests. Inflation, Rothbard said, was legal counterfeiting.

As it turns out, legal counterfeiting is indispensable for maintaining the state’s health because it funds war and increases support for the state. In The Case against the Fed, Rothbard explains:

As luck would have it, the new Federal Reserve System coincided with the outbreak of World War I in Europe, and it is generally agreed that it was only the new system that permitted the U.S. to enter the war and to finance both its own war effort, and massive loans to the allies; roughly, the Fed doubled the money supply of the U.S. during the war and prices doubled in consequence.

Rothbard’s Wall Street, Banks, and American Foreign Policy covers this episode much further, explaining how “World War I came as a godsend” for the financially-troubled Morgan empire and how the Morgan-dominated Fed played a crucial role by creating the money needed to keep the slaughter going and the profits rolling.

The Era of Greenspan

This ongoing increase in the money supply continued into the era of Alan Greenspan. In the years since his insightful defense of gold in 1966, Greenspan had fallen in love with political power. Commenting on Greenspan’s nomination as Fed chairman in 1987, Rothbard noted that

Greenspan’s real qualification is that he can be trusted never to rock the establishment’s boat. He has long positioned himself in the very middle of the economic spectrum . . . he wants moderate deficits and tax increases, and will loudly worry about inflation as he pours on increases in the money supply.

What did Greenspan actually do during his tenure? By the close of 2001, he had increased the money supply by $4.5 trillion as measured by the late M3, more than twice the amount of all other Fed chairmen combined. In late 2002, Nobel laureate Milton Friedman praised Greenspan for having “the best record of any Fed chairman in history.”

Friedman, the alleged champion of free markets, blamed the Great Depression on the Fed for not printing enough money and for not forbidding bank runs. No one ever complained of insufficient “accommodation” under Greenspan’s watch, and it’s no surprise that a man who saw inflation as a necessary element of a modern economy had such praise for Greenspan’s printing press.

Innocent Blunder or Great Hoax?

In a speech on December 19, 2002, Greenspan admitted the Consumer Price Index had gone ballistic in the half century following Franklin D. Roosevelt’s gold confiscation order. However, Greenspan continued by saying that, in recent decades, central bankers had shown they could “contain the forces of inflation” by maintaining more “prudent” monetary policies.

In a similar vein, if anyone should wonder about all those trillions flying off the presses during the 1990s, it was justified by the “New Economy,” in which globalization and information technology would create permanent gains in productivity much like electricity had done during the early decades of the twentieth century. For almost a decade, the technology-dominated NASDAQ index offered living proof of this proposition, soaring from 500 in April 1991 to 5,132 in March 2000. Most importantly, the New Economy, with its innovative inventory and productivity management, had seemingly eliminated the boom–bust cycle, the demon that had haunted capitalism since the advent of the Industrial Revolution. For the first time ever, it seemed the good times were here to stay.

A Sober Voice

However, these good times may be too good to be true. Seventy-five years ago, Garet Garrett wrote:

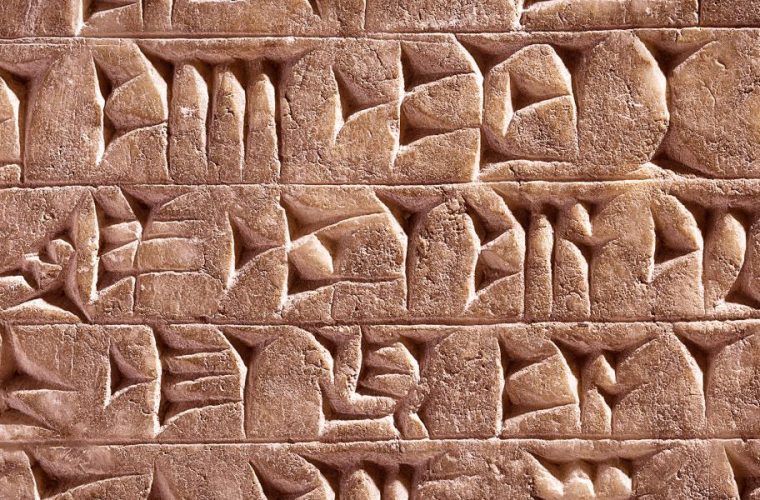

There is a long history of monetary experience. It tells us that government is at heart a counterfeiter and therefore cannot be trusted to control money, and that this is true of both autocratic and popular government. The record has been cumulative since the invention of money. Nevertheless it is not believed. (my emphasis)

Given the federal influence on education, media, and just about everything else, should we be surprised that no one is center stage calling the government a counterfeiter?

However, exposing the fraud, as Garrett said, results in disbelief. People can handle corruption. They can’t handle blatant government theft. That sounds too much like a conspiracy theory, which the public has been taught to ignore.

There are those who see the damage that counterfeiting causes, but they claim the reason is the Fed’s sin of being privately-owned, discounting the government’s role in appointing the Federal Open Market Committee voting majority and other aspects of the system. These same people call for moving the printing presses to some pristine government agency responsible to state bureaucrats, as if the US would be better off if the Fed were run like the Securities and Exchange Commission, the Food and Drug Administration, or the Federal Emergency Management Agency.

It’s hard to imagine the insouciant public not acquiescing in whatever government does to them, but maybe the woke world that has been thrust on us will serve as shock therapy. Perhaps the public will start asking: How can we establish a system of sound money and free banking? The guys running the show certainly won’t ask it for the public.